salt tax deduction explained

11 rows The state and local tax SALT deduction allows taxpayers of high-tax states to deduct. It allows those in high-tax states to deduct the money they spend on local and state taxes.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

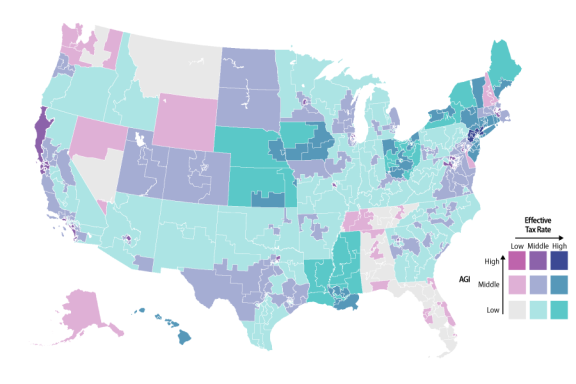

In 2016 taxpayers with AGIs between 0 and 24999.

. Second the 2017 law capped the SALT deduction at 10000 5000 if. Blanca Ocasio-Cortez the mother of the new socialist superstar in Congress did what dozens of parents I know have done. Because of the limit however the taxpayers SALT deduction is only 10000.

Prior to the cap about 78 of the deductions came from incomes greater than. This deduction is a below-the-line tax. Move from New York to Florida.

According to an explanation from the Tax Foundation SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local. The value of the SALT deduction as a percentage of adjusted gross income AGI increases with a taxpayers income. It also meant that the SALT deduction was less useful for taxpayers with lower incomes.

A 10000 ceiling on the previously. But you must itemize in order to deduct state and local taxes on your federal income tax return. Key Takeaways SALT refers to the state and local taxes associated with a federal income tax deduction for taxpayers that itemize their.

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the. The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. The SALT deduction is a tax deduction that is claimed only if you itemize - that is your itemized deductions are greater than your standard deduction and you file a Schedule A which you can.

The deduction went into effect during the 2019 tax year and included a cap of 10000. What is the SALT deduction. 52 rows The state and local tax deduction commonly called the SALT.

SALT stands for the state and local tax deduction that taxpayers can claim when they dont take a standard deduction and choose to itemize.

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

The Salt Cap Overview And Analysis Everycrsreport Com

Salt Deduction Biden S Spending Bill Why A Flat Tax Should Be Considered Steve Forbes Forbes Youtube

Tax Fight Democrats Want Salt Cap Gone In Biden S Big Spending Plans

Why Democrats Are Fighting For A Tax Deduction That Mostly Helps The 1 Foundation For Economic Education

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

Pass Through Entity Tax 101 Baker Tilly

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Is The Salt Deduction H R Block

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

/cdn.vox-cdn.com/uploads/chorus_asset/file/9552921/657004826.jpg)

The State And Local Tax Deduction Explained Vox

10 000 Tax Deduction For State And Local Tax Salt Deduction Itemized Deductions Schedule A Youtube

The Salt Cap Overview And Analysis Everycrsreport Com

State And Local Tax Salt Deduction Salt Deduction Taxedu

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

What Is The Salt Tax Deduction Forbes Advisor

House Democrats Want To Raise Salt Deduction Cap To 80000 What That Means For Your Tax Bill